前言:

在當今充滿機遇與挑戰的時代,藥物行業正迎來一場革命性的變革:減肥註射劑的崛起。藥物巨頭們紛紛投入這一領域,市值飆升,競逐千億市值的巔峰,成為醫藥界的焦點。探尋減肥註射劑的成功之路,揭示背後的挑戰與機遇,以及未來前景的不可思議。

Leaders丨The real skinny

Mar 7th 2024_★★★☆☆_829Words

A frenzy of innovation in obesity drugs is under way

一場肥胖藥的創新熱潮正在興起

Novo Nordisk and Eli Lilly are printing money now. But they will not be a stagnant duopoly

諾和諾德和禮來公司目前似乎賺得盆滿缽滿。但是他們不會一直保持著僵化的雙頭壟斷局面。

"print money" 通常是指一家公司或行業正在大量賺取利潤,好像他們可以隨意印鈔一樣。換句話說,這個詞組暗示著這些公司或行業非常成功,賺取的利潤豐厚且持續穩定。

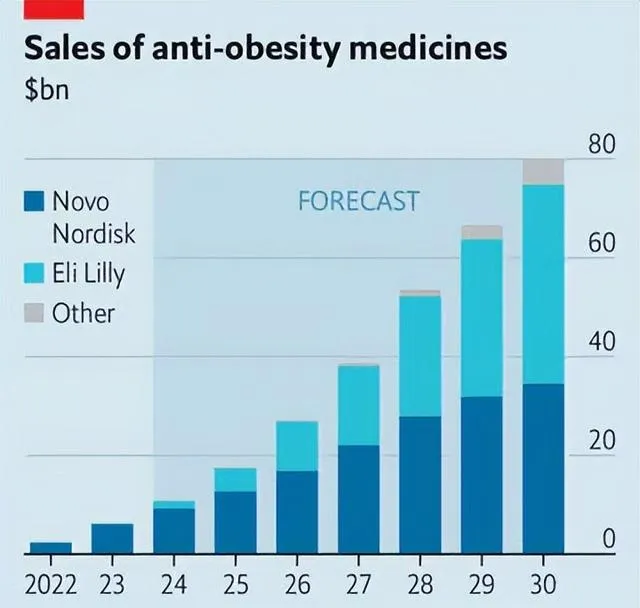

Weight-loss jabs have turned out to be blockbusters . And for good reason. For one thing, after centuries of false promises and quackery , these drugs actually work. With nearly half the world’s population expected to be obese or overweight by 2030, demand for them is assured. And, more excitingly, they may be approved for a broader set of uses. Clinical trials suggest that they could reduce the risk of heart attacks, kidney disease and perhaps even Alzheimer’s. By the end of the decade annual sales of obesity medicines could hit $80bn, making them one of pharma’s biggest classes of drugs.

減肥藥已經成為暢銷藥。這是有道理的。首先,在經歷了幾個世紀的虛假承諾和江湖騙子之後,與之前相比,現在這些藥物確實有效。預計到 2030 年,全球將有近一半的人口肥胖或超重,因此對這些藥物的需求是肯定的。更令人興奮的是,這些藥物可能會被批準用於更廣泛的用途。臨床試驗表明,它們可以降低心臟病發作、腎病甚至阿爾茨海默病的風險。到本十年末,肥胖藥物的年銷售額將達到 800 億美元,成為制藥業最大的藥物類別之一。

jab /dʒæb/ v./n. 戳;刺;捅;猛擊<~ (sth) (in sb/sth) | ~ (at sth) | ~ sb/sth (with sth)>

blockbuster /ˈblɒkbʌstə(r)/ n.一鳴驚人的事物;(尤指)非常成功的書(或電影);大轟動;【記】block(街區,阻礙物)+bust(打破,打碎)+-er(人/物)→能夠把街區、阻礙物都打碎的人或物→大轟動,一鳴驚人的事物

quackery /ˈkwækəri/ n.江湖醫術;庸醫行徑

No wonder enthusiasm for the makers of these drugs, Novo Nordisk and Eli Lilly, is at fever pitch . Since the start of 2023 Novo, maker of Wegovy (and its sibling Ozempic), has seen its market capitalisation soar by 87% to $560bn, making it Europe’s most valuable company. Meanwhile the market value of Lilly, maker of Zepbound (and its sibling Mounjaro), has more than doubled to $740bn. One of these drugmakers could be the first to attain a market value of a trillion dollars, joining an elite club mostly made up of tech firms.

難怪人們對這些藥物的生產商諾和諾德(Novo Nordisk)和禮來(Eli Lilly)熱情高漲。自2023年初以來,Wegovy(及其同類產品Ozempic)的生產商諾和諾德的市值飆升了87%,達到5600億美元,成為歐洲最有價值的公司。與此同時,Zepbound(及其同類產品 Mounjaro)的生產商禮來公司的市值增長了一倍多,達到 7,400 億美元。其中一家制藥公司有可能成為首家市值達到萬億美元的公司,加入主要由科技公司組成的精英俱樂部。

be at fever pitch 處於狂熱狀態

"elite club" 指的是市值達到萬億美元的公司

Add in the limited volumes and high prices for these drugs today, and you might think that this nascent industry is on course to be a price-gouging duopoly. In fact, the market will soon look drastically different from what you see now.

再加之目前這些藥物的產量有限、價格昂貴,你可能會認為這個新興行業正朝著哄擡價格,雙龍頭壟斷的方向發展。事實上,市場很快就會表現得與現在截然不同。

nascent /ˈnæsnt/ adj.新生的;萌芽的;未成熟的

gouge /ɡaʊdʒ/ v.敲(某人)的竹杠;(向某人)詐騙錢財,漫天要價<gouge sth↔out (of sth) 摳出某物;挖出某物>

duopoly /djuːˈɒpəli/ n.(商品或服務的)兩強壟斷;兩強壟斷集團【記】monopoly 壟斷:mono-(單一的);duo-(雙)

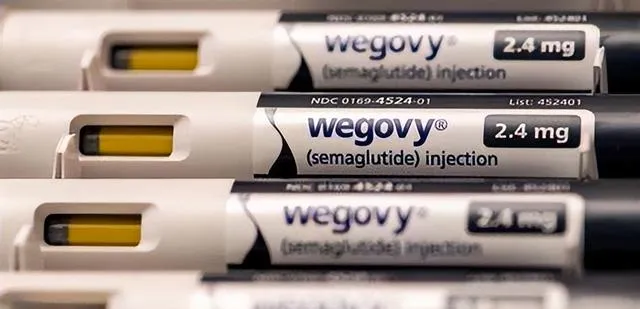

Right now the drugs are in short supply. Shortages of their active ingredients, like semaglutide for Wegovy, and of the skinny 「pens」 used to inject the medicine, are a constraint on production. And with a list price of almost $16,000 a year, these treatments are not cheap. Although a few users may be able to afford the cost themselves, most will need help from insurers or health services—many of which have yet to be convinced that the benefits are worth the drugs’ eye-watering prices.

目前,這些藥物供不應求。藥物的活性成分(如用於Wegovy的塞馬魯肽(semaglutide))和用於註射藥物的「筆型」器材都存在供應限制,這對藥物生產構成了一定的制約。而且,這些治療藥物每年的上市價格將近 16,000 美元,並不便宜。盡管少數使用者可能自己負擔得起,但大多數人需要保險公司或醫療服務機構的幫助,許多機構尚未被說服這些藥物的效益是否能抵得上其高昂的價格。

Access will be an even bigger problem in much of the emerging world, which is projected to experience the largest increases in obesity as incomes rise and diets change.① So far most of Lilly’s and Novo’s sales have been in America, with the rest going mainly to Europe. Nor does it help emerging-world patients that the jabs need to be refrigerated, making them unsuitable for use in countries with less developed supply chains.

在許多新興國家,準入將是一個更大的問題,隨著收入的增加和飲食習慣的改變,肥胖癥的發病率預計將大幅上升。到目前為止,禮來和諾和諾德的大部份銷售額都在美國,其余的主要銷往歐洲。而且,這種藥物需要冷藏保存,因此不適合在供應鏈不發達的國家使用,這對新興國家的患者也沒有幫助。

Yet there are good reasons to think that in future the market will see expanded supply, lower prices and a more global patient base. For a start, investment by Lilly and Novo to expand production should ease bottlenecks over time. Both firms are pouring billions of dollars into boosting supply by building their own capacity and teaming up with other manufacturers. Lilly and Novo are also racing to gain an edge over each other. Novo has already developed a pill that is about as effective as its injectable version. Lilly expects to launch its own obesity pill in a few years. Both companies also have newer versions of the drugs in the late stages of development which are more efficacious or have fewer side-effects.

然而,我們有充分的理由相信,未來市場將出現供應擴大、價格下降和更廣泛的全球患者基數的局面。首先,隨著時間的推移,禮來和諾和諾德擴大生產的投資應該會緩解瓶頸問題。兩家公司都在投入數十億美元,透過提高自身產能和與其他制造商合作來增加供應量。同時,禮來和諾和諾德也在競相爭奪彼此的優勢。諾和諾德已經開發出一種藥片,其療效與其註射劑差不多。禮來預計將在未來幾年內推出自己的肥胖藥片。此外,兩家公司都有目前也已經處於後期開發階段的新藥,它們的療效更好或副作用更小。

More important in the long term, however, is the array of competitors preparing to enter the market. Wegovy, Zepbound and their ilk are less protected by patents than, say, Humira, a blockbuster anti-inflammatory drug that has reaped more than $200bn in sales over 20 years.

不過,從長遠來看,更重要的是一系列準備進入市場的競爭者。與過去20年銷售額超過2,000億美元的暢銷抗炎藥Humira等產品相比,Wegovy、Zepbound及其同類產品的專利保護較弱。

Already more than 70 companies are running close to 100 clinical trials for obesity drugs. These include big pharma firms (Amgen and Boehringer Ingelheim) and smaller biotechs (Viking Therapeutics and Structure Therapeutics) in the West, as well as Chinese drugmakers such as Sciwind Biosciences and Eccogene. Many are testing versions that are distinct enough from Wegovy and Zepbound that patent protections will not apply, allowing them to come to market within a few years, should they gain regulators’ blessing.②

目前已有 70 多家公司正在進行近 100 項肥胖藥物臨床試驗。其中包括西方的大型制藥公司(安進公司和勃林格殷格翰公司)和小型生物技術公司(維京治療公司和碩迪生物),以及中國的制藥公司,如杭州先為達(Sciwind Biosciences)生物科技有限公司和上海誠益(Eccogene)生物科技有限公司。許多公司正在測試的新藥與Wegovy和Zepbound的區別很大,因此不適用專利保護,如果這些藥物獲得監管機構的批準,就可以在幾年內上市。

Some candidates in the pipeline could be more effective than existing treatments; others might do away with the inconvenience of today’s drugs, which require patients to inject themselves once a week and to continue taking them indefinitely to keep their weight down. Viking’s experimental drug, for example, has been shown to help patients shed more weight than existing jabs. Amgen is testing a treatment that does not require patients to be on the drugs indefinitely. And Structure is developing a promising-looking pill.

一些正在研發的候選藥物可能比現有的治療方法更有效;另一些藥物則可能消除現有藥物帶來的不便,比如,這些藥物要求患者每周註射一次,並無限期地持續服用,以維持體重。例如,維京公司的實驗性藥物已經被證明,與現有的註射劑相比,它能幫助患者減輕更多的體重。安進公司正在測試一種無需患者無限期服藥的治療方法。結構公司正在開發一種看起來很有前景的藥丸。

Healthy competition

This frenzy of innovation is welcome. Lilly and Novo may lose their lead in the long term if cheaper alternatives arise; or they may themselves furiously innovate to reduce costs. Either way, prices should come down, making the drugs more accessible to patients around the world. Today the two pharma firms are reaping the rewards from their blockbuster drugs. But in time it will be consumers who benefit most of all. ■

良性競爭

這股創新熱潮是值得歡迎的。從長遠來看,如果出現更便宜的替代品,禮來和諾和諾德可能會失去領先地位;或者它們自己也會瘋狂創新以降低成本。無論如何,價格都會下降,使全球患者更容易獲得這些藥物。如今,這兩家制藥公司正從其暢銷藥物中獲得豐厚回報。但隨著時間的推移,受益最大的將是消費者。

SUMMARY

這篇文章討論了減肥註射藥物在制藥行業取得的成功和潛在影響。

由於全球肥胖問題日益嚴重,並且這些藥物可能帶來的益處不僅限於減肥,還包括降低心臟病發作和其他疾病的風險,這些藥物的市場需求巨大。舉例提到諾和諾德和禮來等公司因肥胖藥物備受歡迎而市值飆升。

然而,文章也提到了一些挑戰,比如供應有限、價格高昂以及新興市場的準入問題,這些都是廣泛采用這些藥物面臨的障礙。盡管存在這些挑戰,人們對未來市場持樂觀態度,預計供應將增加,價格將下降,並且患者群體將更加多樣化。隨著新參與者進入市場,開發創新藥物,競爭預計會加劇,但是最終收益最大的還是消費者。

英文&音訊取自【經濟學人】官網,部份圖源網絡,侵刪

轉譯&精讀內容歸本人所有,可前往賬號詳細學習[奮鬥]

轉載請註明出處,違者必究!更多內容,請前往官網學習