前言:

在当今充满机遇与挑战的时代,药物行业正迎来一场革命性的变革:减肥注射剂的崛起。药物巨头们纷纷投入这一领域,市值飙升,竞逐千亿市值的巅峰,成为医药界的焦点。探寻减肥注射剂的成功之路,揭示背后的挑战与机遇,以及未来前景的不可思议。

Leaders丨The real skinny

Mar 7th 2024_★★★☆☆_829Words

A frenzy of innovation in obesity drugs is under way

一场肥胖药的创新热潮正在兴起

Novo Nordisk and Eli Lilly are printing money now. But they will not be a stagnant duopoly

诺和诺德和礼来公司目前似乎赚得盆满钵满。但是他们不会一直保持着僵化的双头垄断局面。

"print money" 通常是指一家公司或行业正在大量赚取利润,好像他们可以随意印钞一样。换句话说,这个词组暗示着这些公司或行业非常成功,赚取的利润丰厚且持续稳定。

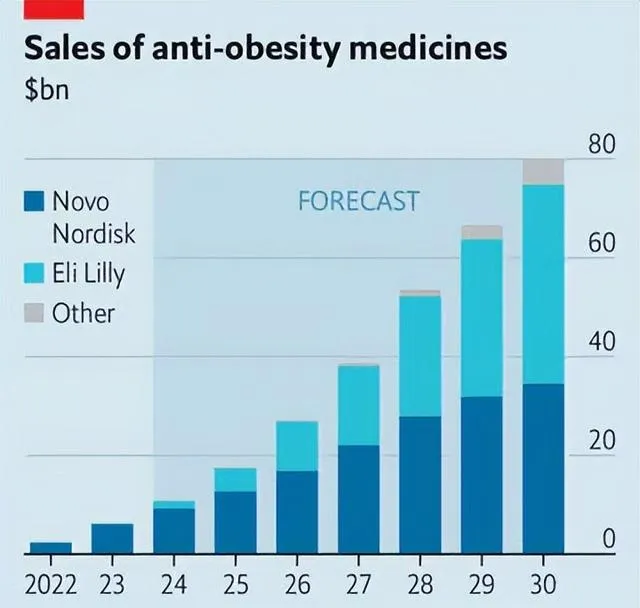

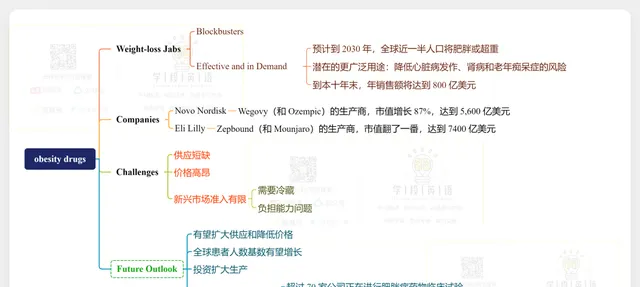

Weight-loss jabs have turned out to be blockbusters . And for good reason. For one thing, after centuries of false promises and quackery , these drugs actually work. With nearly half the world’s population expected to be obese or overweight by 2030, demand for them is assured. And, more excitingly, they may be approved for a broader set of uses. Clinical trials suggest that they could reduce the risk of heart attacks, kidney disease and perhaps even Alzheimer’s. By the end of the decade annual sales of obesity medicines could hit $80bn, making them one of pharma’s biggest classes of drugs.

减肥药已经成为畅销药。这是有道理的。首先,在经历了几个世纪的虚假承诺和江湖骗子之后,与之前相比,现在这些药物确实有效。预计到 2030 年,全球将有近一半的人口肥胖或超重,因此对这些药物的需求是肯定的。更令人兴奋的是,这些药物可能会被批准用于更广泛的用途。临床试验表明,它们可以降低心脏病发作、肾病甚至阿尔茨海默病的风险。到本十年末,肥胖药物的年销售额将达到 800 亿美元,成为制药业最大的药物类别之一。

jab /dʒæb/ v./n. 戳;刺;捅;猛击<~ (sth) (in sb/sth) | ~ (at sth) | ~ sb/sth (with sth)>

blockbuster /ˈblɒkbʌstə(r)/ n.一鸣惊人的事物;(尤指)非常成功的书(或电影);大轰动;【记】block(街区,阻碍物)+bust(打破,打碎)+-er(人/物)→能够把街区、阻碍物都打碎的人或物→大轰动,一鸣惊人的事物

quackery /ˈkwækəri/ n.江湖医术;庸医行径

No wonder enthusiasm for the makers of these drugs, Novo Nordisk and Eli Lilly, is at fever pitch . Since the start of 2023 Novo, maker of Wegovy (and its sibling Ozempic), has seen its market capitalisation soar by 87% to $560bn, making it Europe’s most valuable company. Meanwhile the market value of Lilly, maker of Zepbound (and its sibling Mounjaro), has more than doubled to $740bn. One of these drugmakers could be the first to attain a market value of a trillion dollars, joining an elite club mostly made up of tech firms.

难怪人们对这些药物的生产商诺和诺德(Novo Nordisk)和礼来(Eli Lilly)热情高涨。自2023年初以来,Wegovy(及其同类产品Ozempic)的生产商诺和诺德的市值飙升了87%,达到5600亿美元,成为欧洲最有价值的公司。与此同时,Zepbound(及其同类产品 Mounjaro)的生产商礼来公司的市值增长了一倍多,达到 7,400 亿美元。其中一家制药公司有可能成为首家市值达到万亿美元的公司,加入主要由科技公司组成的精英俱乐部。

be at fever pitch 处于狂热状态

"elite club" 指的是市值达到万亿美元的公司

Add in the limited volumes and high prices for these drugs today, and you might think that this nascent industry is on course to be a price-gouging duopoly. In fact, the market will soon look drastically different from what you see now.

再加之目前这些药物的产量有限、价格昂贵,你可能会认为这个新兴行业正朝着哄抬价格,双龙头垄断的方向发展。事实上,市场很快就会表现得与现在截然不同。

nascent /ˈnæsnt/ adj.新生的;萌芽的;未成熟的

gouge /ɡaʊdʒ/ v.敲(某人)的竹杠;(向某人)诈骗钱财,漫天要价<gouge sth↔out (of sth) 抠出某物;挖出某物>

duopoly /djuːˈɒpəli/ n.(商品或服务的)两强垄断;两强垄断集团【记】monopoly 垄断:mono-(单一的);duo-(双)

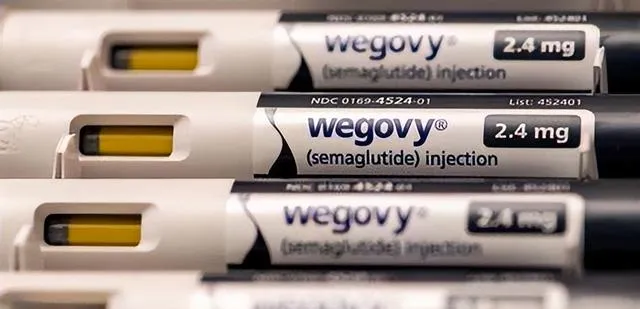

Right now the drugs are in short supply. Shortages of their active ingredients, like semaglutide for Wegovy, and of the skinny 「pens」 used to inject the medicine, are a constraint on production. And with a list price of almost $16,000 a year, these treatments are not cheap. Although a few users may be able to afford the cost themselves, most will need help from insurers or health services—many of which have yet to be convinced that the benefits are worth the drugs’ eye-watering prices.

目前,这些药物供不应求。药物的活性成分(如用于Wegovy的塞马鲁肽(semaglutide))和用于注射药物的「笔型」设备都存在供应限制,这对药物生产构成了一定的制约。而且,这些治疗药物每年的上市价格将近 16,000 美元,并不便宜。尽管少数使用者可能自己负担得起,但大多数人需要保险公司或医疗服务机构的帮助,许多机构尚未被说服这些药物的效益是否能抵得上其高昂的价格。

Access will be an even bigger problem in much of the emerging world, which is projected to experience the largest increases in obesity as incomes rise and diets change.① So far most of Lilly’s and Novo’s sales have been in America, with the rest going mainly to Europe. Nor does it help emerging-world patients that the jabs need to be refrigerated, making them unsuitable for use in countries with less developed supply chains.

在许多新兴国家,准入将是一个更大的问题,随着收入的增加和饮食习惯的改变,肥胖症的发病率预计将大幅上升。到目前为止,礼来和诺和诺德的大部分销售额都在美国,其余的主要销往欧洲。而且,这种药物需要冷藏保存,因此不适合在供应链不发达的国家使用,这对新兴国家的患者也没有帮助。

Yet there are good reasons to think that in future the market will see expanded supply, lower prices and a more global patient base. For a start, investment by Lilly and Novo to expand production should ease bottlenecks over time. Both firms are pouring billions of dollars into boosting supply by building their own capacity and teaming up with other manufacturers. Lilly and Novo are also racing to gain an edge over each other. Novo has already developed a pill that is about as effective as its injectable version. Lilly expects to launch its own obesity pill in a few years. Both companies also have newer versions of the drugs in the late stages of development which are more efficacious or have fewer side-effects.

然而,我们有充分的理由相信,未来市场将出现供应扩大、价格下降和更广泛的全球患者基数的局面。首先,随着时间的推移,礼来和诺和诺德扩大生产的投资应该会缓解瓶颈问题。两家公司都在投入数十亿美元,通过提高自身产能和与其他制造商合作来增加供应量。同时,礼来和诺和诺德也在竞相争夺彼此的优势。诺和诺德已经开发出一种药片,其疗效与其注射剂差不多。礼来预计将在未来几年内推出自己的肥胖药片。此外,两家公司都有目前也已经处于后期开发阶段的新药,它们的疗效更好或副作用更小。

More important in the long term, however, is the array of competitors preparing to enter the market. Wegovy, Zepbound and their ilk are less protected by patents than, say, Humira, a blockbuster anti-inflammatory drug that has reaped more than $200bn in sales over 20 years.

不过,从长远来看,更重要的是一系列准备进入市场的竞争者。与过去20年销售额超过2,000亿美元的畅销抗炎药Humira等产品相比,Wegovy、Zepbound及其同类产品的专利保护较弱。

Already more than 70 companies are running close to 100 clinical trials for obesity drugs. These include big pharma firms (Amgen and Boehringer Ingelheim) and smaller biotechs (Viking Therapeutics and Structure Therapeutics) in the West, as well as Chinese drugmakers such as Sciwind Biosciences and Eccogene. Many are testing versions that are distinct enough from Wegovy and Zepbound that patent protections will not apply, allowing them to come to market within a few years, should they gain regulators’ blessing.②

目前已有 70 多家公司正在进行近 100 项肥胖药物临床试验。其中包括西方的大型制药公司(安进公司和勃林格殷格翰公司)和小型生物技术公司(维京治疗公司和硕迪生物),以及中国的制药公司,如杭州先为达(Sciwind Biosciences)生物科技有限公司和上海诚益(Eccogene)生物科技有限公司。许多公司正在测试的新药与Wegovy和Zepbound的区别很大,因此不适用专利保护,如果这些药物获得监管机构的批准,就可以在几年内上市。

Some candidates in the pipeline could be more effective than existing treatments; others might do away with the inconvenience of today’s drugs, which require patients to inject themselves once a week and to continue taking them indefinitely to keep their weight down. Viking’s experimental drug, for example, has been shown to help patients shed more weight than existing jabs. Amgen is testing a treatment that does not require patients to be on the drugs indefinitely. And Structure is developing a promising-looking pill.

一些正在研发的候选药物可能比现有的治疗方法更有效;另一些药物则可能消除现有药物带来的不便,比如,这些药物要求患者每周注射一次,并无限期地持续服用,以维持体重。例如,维京公司的实验性药物已经被证明,与现有的注射剂相比,它能帮助患者减轻更多的体重。安进公司正在测试一种无需患者无限期服药的治疗方法。结构公司正在开发一种看起来很有前景的药丸。

Healthy competition

This frenzy of innovation is welcome. Lilly and Novo may lose their lead in the long term if cheaper alternatives arise; or they may themselves furiously innovate to reduce costs. Either way, prices should come down, making the drugs more accessible to patients around the world. Today the two pharma firms are reaping the rewards from their blockbuster drugs. But in time it will be consumers who benefit most of all. ■

良性竞争

这股创新热潮是值得欢迎的。从长远来看,如果出现更便宜的替代品,礼来和诺和诺德可能会失去领先地位;或者它们自己也会疯狂创新以降低成本。无论如何,价格都会下降,使全球患者更容易获得这些药物。如今,这两家制药公司正从其畅销药物中获得丰厚回报。但随着时间的推移,受益最大的将是消费者。

SUMMARY

这篇文章讨论了减肥注射药物在制药行业取得的成功和潜在影响。

由于全球肥胖问题日益严重,并且这些药物可能带来的益处不仅限于减肥,还包括降低心脏病发作和其他疾病的风险,这些药物的市场需求巨大。举例提到诺和诺德和礼来等公司因肥胖药物备受欢迎而市值飙升。

然而,文章也提到了一些挑战,比如供应有限、价格高昂以及新兴市场的准入问题,这些都是广泛采用这些药物面临的障碍。尽管存在这些挑战,人们对未来市场持乐观态度,预计供应将增加,价格将下降,并且患者群体将更加多样化。随着新参与者进入市场,开发创新药物,竞争预计会加剧,但是最终收益最大的还是消费者。

英文&音频取自【经济学人】官网,部分图源网络,侵删

翻译&精读内容归本人所有,可前往账号详细学习[奋斗]

转载请注明出处,违者必究!更多内容,请前往官网学习